TRAVERSE Global v11.1

Payment Service Integration

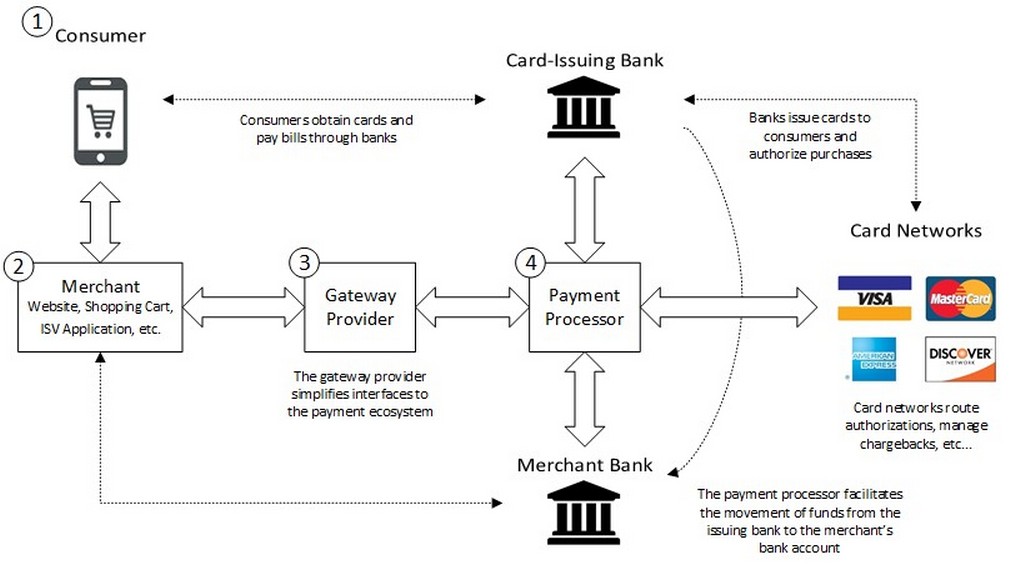

When consumers make an electronic purchase using a credit or debit card (or a digital or mobile wallet backed by stored credentials), a variety of players from banks to credit card companies to payment processors cooperate to facilitate the transaction. The process can vary depending on the nature of the gateway and payment.

What makes this a little complex is that multiple parties can operate a gateway. For example, a merchant’s bank (the acquiring bank) may act as the payment processor or have a relationship with a payment processor. In some cases, a payment processor will operate their own gateway, and in other cases, a third party will operate the gateway. In other cases (not shown in the diagram) a gateway might route transactions through another gateway to offer a great number of back-end processors. In fact, often a transaction will traverse multiple gateways before a payment is finally processed.

Payment Process Sample

- The consumer makes a purchase: The consumer starts by presenting their payment credentials to a merchant. This can be done in a variety of ways including keying a card number on a website, using a mobile app, or swiping/dipping a card at a point of sale.

- The merchant relays the payment request to a gateway: Merchants may have their own custom application (a website or mobile app for example) or they may rely on a third-party shopping cart or integrated point of sale provider already integrated to a gateway.

- The gateway provider receives the request: When the gateway provider receives a transaction, they typically relay authorizations or other instructions to a payment processor. Some large gateways have relationships with a specific processor, while others have connections to multiple processors.

For example, in the case of Vantiv (now Worldpay), they have a Payment Gateway, Express Gateway. Gateways can link to their own payment processor or to multiple Payment Processors such as TSYS, First Data, PayPal, Authorize.net, etc. This is based on the merchant needs and the complexity of their business.

- The payment processor facilitates the transaction: On receipt of a request from the gateway, the payment processor relays the request to the appropriate card brand that will in turn route the request to the appropriate issuing bank for authorization. Assuming there are sufficient funds and the account is in good standing, the bank and card brand will relay an approval back to the processor that will in turn be relayed to the gateway and ultimately the merchant. The payment processor facilitates the movement of money from the cardholder’s issuing bank (who is essentially loaning the consumer money until they pay their credit card bill) to the appropriate merchant bank account.

Example using the diagram above…

John Doe is a Consumer shopping at Insta-Mart (a Merchant). He uses his Visa card (Card Brand) to make his purchase.

Insta-Mart uses Vantiv’s (now Worldpay) Express Payment Gateway to interface to First Data (Payment Processor).

First-Data facilitates moving John’s money at First Bank(Issuing Bank) to Insta-Mart’s bank (Merchant Bank).

Setup

See the TRAVERSE Payment System Overview for more information.

Payment Service Integration

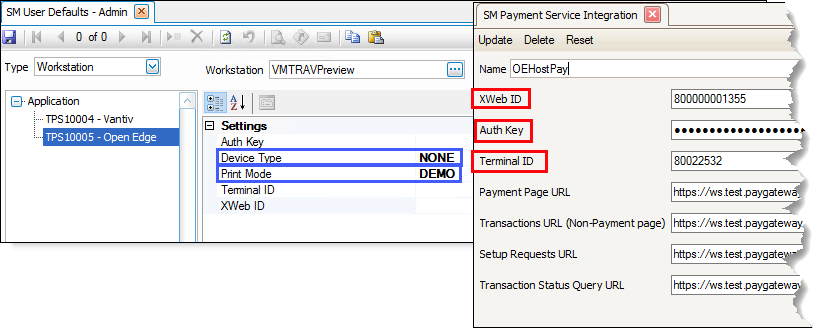

In the System Manager Setup and Maintenance menu, open the Payment Service Integration screen. To configure a payment service, enter or select the name of the payment service in the Name drop-down list. Once you select a service provider, the screen will display a number of data entry fields required for the integration to function properly. You must have an account with the payment service to obtain the credentials required for TRAVERSE.

- Enter/select 'OEHostPay' for the Name of the OpenEdge setup.

- Enter your company's ID as provided by the payment processor into the XWeb ID field.

- Enter the authorization key your payment processor supplied into the Auth Key field.

- If applicable, enter the terminal ID for the current terminal into the Terminal ID field.

- Enter the URL for the payment processing service in the Payment Page URL field.

- Enter the transaction URL for your provider into the Transactions URL (Non-Payment page) field.

- Enter the URL for setup requests to the payment processor in the Setup Requests URL field.

- Enter the URL for transaction status queries in the Transaction Status Query URL field.

Click a command button to:

| Click | To |

| Update | Update the payment service settings with the values you just edited. |

| Delete | Delete the payment service selected. |

| Reset | Set all fields to the most recent values entered. |

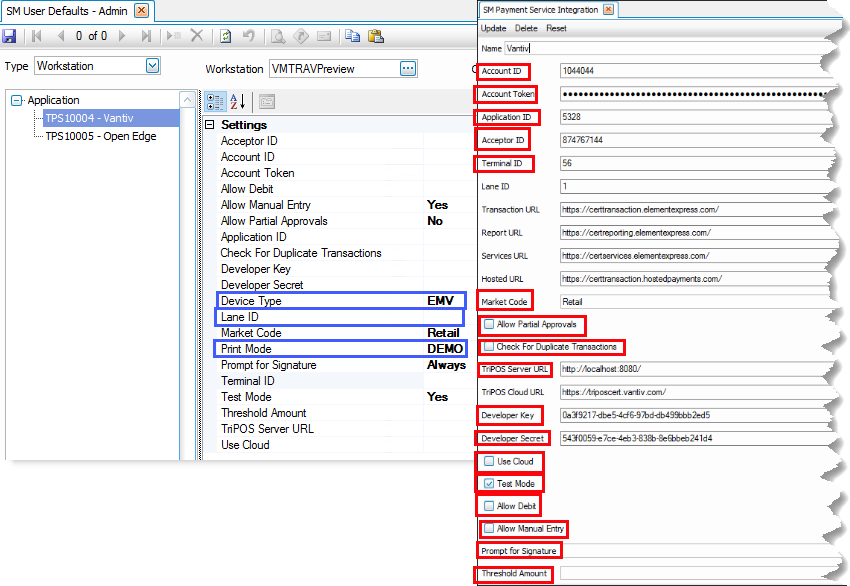

- In the Name field, select/enter 'Vantiv' for the Vantiv/Worldpay setup.

- Enter your company's account ID as provided by the payment processor into the Account ID field.

- Enter your company's account token in the Account Token field. Click the square button on the right side of the field to show the account token value.

- Enter 5328 in the Application ID field.

- Enter the acceptor ID in the Acceptor ID field.

- If applicable, enter the terminal ID for the current terminal into the Terminal ID field.

- If applicable, enter the lane ID for the current terminal into the Lane ID field. Lanes are used to link EMV devices to the port or computer the EMV is connected to. Use the Lane Manager function, via the button on the toolbar, to add lanes (EMV devices) to the system.

- Enter the transaction URL for your settlement provider into the Transaction URL field.

- Enter the report URL for your settlement provider into the Report URL field.

- Enter the services URL for the payment processing service in the Services URL field.

- The Hosted URL should be set as needed for your gateway. Edit these values only if necessary.

- Select a Market Code from the drop-down list that most accurately describes the service.

- Select the check box to Allow Partial Approvals to approve a portion of the payment prior to processing the TRAVERSE transaction.

- Select the check box to Check For Duplicate Transactions when entering payments into transactions. The process will check for duplicate Customer ID, Amount, and Credit Card Number.

- Enter the TriPOS server URL for the payment processing service in the TriPOS Server URL field.

- Enter the TriPOS cloud URL for the payment processing service in the TriPOS Cloud URL field.

- Enter the developer key your payment processor supplied into the Developer Key field.

- Enter the developer secret into the Developer Secret field.

- If using an EMV device (card reader) connected directly to the network, which is the normal configuration when TRAVERSE runs in the cloud or users access TRAVERSE via Remote Desktop, mark the Use Cloud check box; otherwise, if the EMV is connected directly to client computers, leave the check box blank.

- The Test Mode field setting allows for testing the configuration. Mark the Test Mode check box to test payment processing. Clear the check box to enable payment processing for customers.

- Select the check box to Allow Debit cards to be used along with credit cards. Otherwise, clear the check box to allow credit cards only.

- Select the check box to Allow Manual Entry of the credit card number on the EMV if a card can’t be swiped. Otherwise, clear the check box to use the EMV device exclusively to capture the credit card information.

- Select how you want to use signature capture functionality for your payment services from the Prompt for Signature drop-down list.

- If you choose to require a signature above a dollar amount, enter that dollar amount into the Threshold Amount field. If you are not using the threshold, or do not have a threshold amount, enter 0 into the field.

Click a command button to:

| Click | To |

| Update | Update the payment service settings with the values you just edited. |

| Delete | Delete the payment service selected. |

| Reset | Set all fields to the most recent values entered. |

OpenEdge: If you are going to use a card reader device (EMV), you will need to install RCM Windows_GA.exe. The RCM program has a Device Configure option that will allow you to change the communication port that the device uses if necessary, such as COM4 or COM6.

Vantiv Cloud: There is no additional software to install. Connect the EMV directly to the network; the EMV is available to multiple users on the network. If you connect the EMV device to a port, use the Lane Manager function to pair the device with the port to which it is connected. When a device is plugged into a port and it has not been paired to Express API credentials, it will boot up and display an Activation Code to use in the Lane Manager function. Work with your payment service provider to install the required software to connect and run the card reader.

Vantiv/Worldpay Direct: You must run the triPOS Setup.exe installation. This creates a Windows Service (triPOS.NET) that is required for the EMV to work. The default installation path is: C:\Program Files (x86)\Vantiv. There is also a triPOS.config file created in the C:\Program Files (x86)\Vantiv\triPOS Service folder that may need to be configured. Connect the EMV to the computer with triPOS installed; the EMV is only available to that computer.

Payment Methods

In the AR Payment Methods screen from the AR Setup and Maintenance menu, create a new payment method ID for the credit card processor you are using, and select a Payment Type of 'External'. You set up the external payment method(s) as you would a credit card method such as VISA, so make sure you also select a GL Account and an opt ional CC Company ID. If you leave CC Company ID blank, open invoices for payments are not created, which eliminates the need to create additional cash receipts to offset the entries. See the AR Payment Methods topic for more information on setting up a payment method.

Business Rules

In the System Manager Business Rules, in the SM Defaults – Services section, select a Payment Provider to use for credit card processing.

The Payment Provider business rule must be set separately for Point-of-Sale and Portal applications.

Under TPS Settings:

NOTE: You must select the AR Payment Method for OpenEdge and/or Vantiv. If you do not select a value for one of these AR payment methods, external-type credit card payments will not function correctly.

- Select an AR Payment Method ID for OpenEdge, as applicable.

- Select an AR Payment Method ID for Vantiv/Worldpay, as applicable.

- If you want to save a PDF copy of the receipts to the database (archive the receipts), select ‘Yes’ to Use Archive, and enter text for the Archive Watermark.

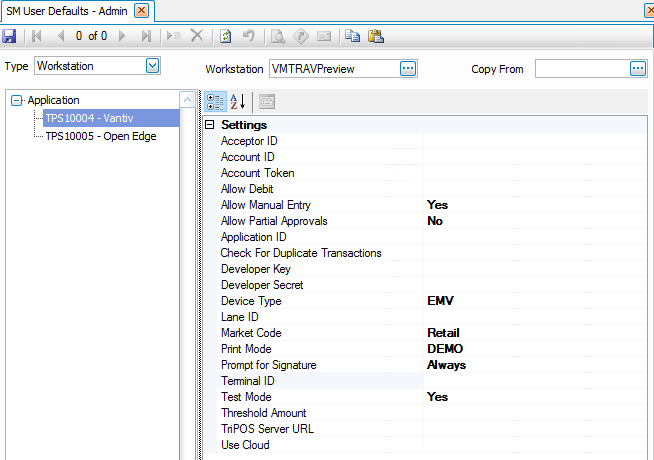

If you have workstations that use settings which are different than those you entered in the Payment Service Integration screens, you can use the Workstation defaults option in the User Defaults – Admin function found on the SM Company Setup menu. Use this option to configure a workstation to use a credit card reader, show a print preview (for testing purposes) rather than printing a receipt, or set a workstation up for a different method of utilizing the payment service, such as retail workstations rather than MOTO (mail order/telephone order). You can configure certain workstations to use a Retail account by entering the applicable settings in the workstation defaults screen.

The options that can be set per workstation may differ depending on the payment service you are using. Options may include allowing manual entry, device type, print mode, prompting for signature, terminal ID, and lane ID, among others.

To set up workstation defaults, open the User Defaults – Admin function from the SM Company Setup menu.

- Select ‘Workstation’ as the Type of default from the drop-down list.

- In the Workstation field, if you are entering a new workstation, enter the workstation name into the field. If you are editing the workstation, select it from the drop-down list.

- If you are entering a new workstation, you have the option to copy defaults from another workstation by selecting an existing workstation in the Copy From drop-down list.

- The settings for the selected payment service are also available on the Payment Service Integration configuration screen for the payment service. Settings you select in the User Defaults – Admin function will override the global settings on the Payment Service Integration screen.

The settings outlined in blue are only found on the User Defaults – Admin screen. The settings outlined in red appear in both screens.

Vantiv/Worldpay

OpenEdge

- If you want the workstation to use a credit card reader, such as in a retail situation, set the DeviceType value to ‘EMV’. If you set the DeviceType value to 'NONE', the user must enter credit card information manually.

- For Vantiv/Worldpay, if you set the DeviceType to ‘EMV’, and the device has been paired to a port using the Lane Manager function, enter the Lane ID for the device.

- By default, the workstation will print the receipt right after the card is processed. You can set the PrintMode value to ‘PRINT’ to get the same results. If you want the workstation to display a print preview of the receipt, such as during testing, set the PrintMode value to 'DEMO'.

NOTE: The print preview of the receipt will not allow you to save or print the receipt. If you have archiving turned on in the SM business rules, a PDF of the receipt is saved as an archived document, which will allow you to retrieve the receipt if needed.

- If the workstation utilizes the payment service differently than others, such as a retail workstation rather than MOTO (mail order/telephone order), you can configure the workstation to use a Retail account by entering the applicable settings.

- When you are finished editing settings, click the Save button on the toolbar.

NOTE: To view the saved workstation defaults, you must close the User Defaults – Admin screen, then reopen it.

Entering Payments

After you have set up the payment service integration, you always use the Payments button on the toolbar to set up a new credit card for a customer, to enter an external payment, or to set up a credit card payment for a recurring entry. See the topics for the AR Payments button and the SO Payments button for more information.

If there is no external payment method on file, click the New button to open a credit card information entry form.

When you are not using an EMV (credit card reader), you will enter the credit card info on the credit card information entry form that displays. When you are using an EMV, you will be directed to the EMV device to swipe, tap, or insert (if chip) the card. You can also use an EMV device, if available, to enter a new card for a customer.

MMMMM

MMMMM

See the TPS Overview for more information, as well as some examples.